Last modified:

Manage financial models that are the base for your forecasts.

A financial model is a mathematical tool that consists of formulas and assumptions to represent a company's operations in the past, present, and forecasted future. Financial models are used for decision-making and financial analysis.

Example

Financial models can be used to:

-

Estimate the costs and project the profits of a proposed new project.

-

Model feed-in tariffs, investment subsidies, current power purchase agreements, or market price structures.

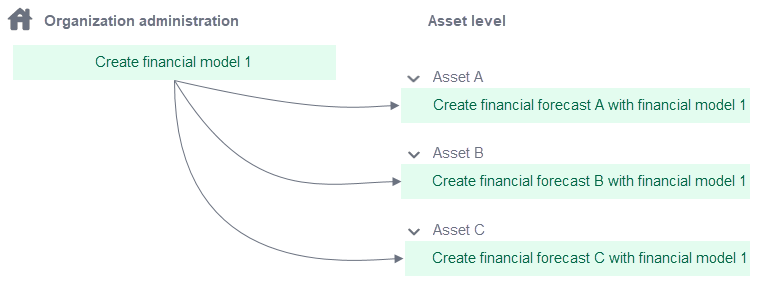

In mc Assetpilot you create all of your organization’s financial models on the organization level. In the administration settings you can view, create, and maintain the financial models for your entire organization.

Financial models and financial forecasts

A financial model is some sort of a basic framework for the financial forecasts you create at the asset levels. It does not contain any specific values, but only variables and placeholder parameters. The real data – which is individually different depending on your asset – is only entered later when you create financial forecasts. This eliminates the need for multiple spreadsheets for each asset.

The basic workflow for financial models and forecasts is as follows:

Views of the financial models domain

Enter the financial models domain by navigating to the administration settings: In platform view, select

Overview

In the overview, you see a list of all your organization’s financial models.

Expanded view

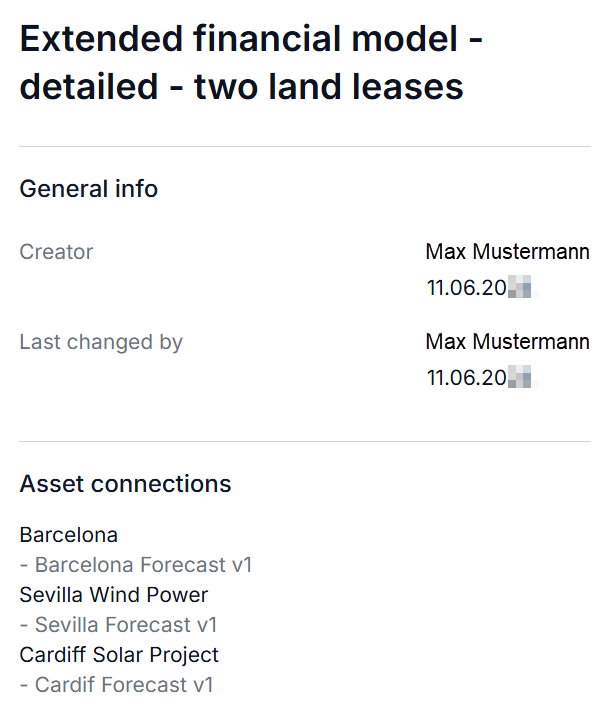

Select a financial model in the overview to display an expanded view of its details in a side panel.

In the area Asset connections you find the assets and their financial forecasts which use this particular financial model.

Create a financial model

Prerequisites for the whole process

-

You are the organization owner or an admin.

0) Enter basic data

Steps

-

In platform view, select

-

Select + New financial model.

-

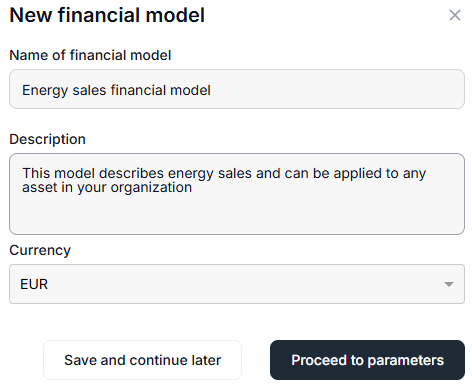

Give the model a Name. You can also add a Description if desired.

-

Enter a Currency.

Caution

Be aware of any secondary currencies that are assigned to the asset levels the financial model should be used at. See also Currencies.

-

Select Proceed to parameters.

Example

Create the financial model:

-

Energy sales financial model with the currency EUR

1) Define types of project phases

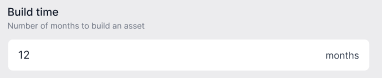

To build your financial model, you must specify types of project phases that represent the phases of a project's financial lifetime. Create phases specific to your company's standards. You only add specific dates to the phase at a later stage when you create financial forecasts. See Financial forecasts.

Steps

-

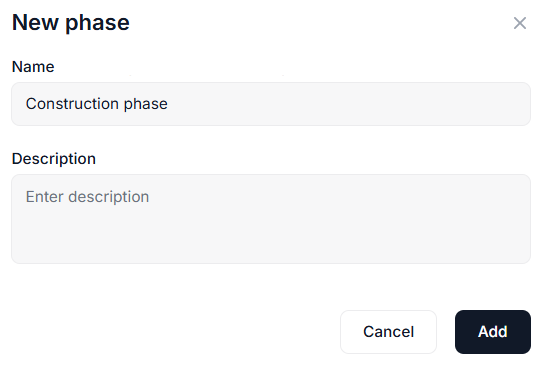

In the Phases area, select +New phase.

-

Enter a phase Name and add a Description if desired.

-

Select Add. The phase will be added to your list of phases.

Further actions

-

Add additional phases in the same manner if needed.

-

Note

You can not delete and just partially edit a phase with the badge In use. This indicates that this phase is in use in a calculation. Remove the phase from the calculation first, to delete and fully edit it.

Example

Create the phases:

-

Construction phase

-

Operation phase

2) Define types of parameters

The next step in creating a financial model is to create the parameters you will need. Each parameter you create must have a unique name. The type, parameter group, and unit are also mandatory. You only add specific values to each parameter at a later stage when you create financial forecasts. See Financial forecasts.

Steps

-

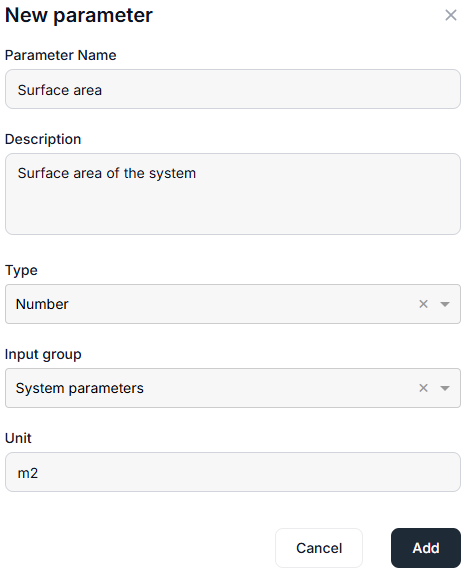

In the Parameters area, select +New parameter.

-

Enter a parameter Name and add a Description if desired.

-

Select parameter Type, Input group, and enter a Unit. To learn more about these data fields, see descriptions above.

-

Select Add. The parameter will be added to your list of parameters.

Further actions

-

Add additional parameters in the same manner if needed.

-

Note

You can not delete and just partially edit a parameter with the badge In use. This indicates that this parameter is in use in a calculation. Remove the parameter from the calculation first, to delete and fully edit it.

Example

Create the parameters:

-

Surface area: m2

-

Generated energy per square meter: MWh/m2

-

Power purchase agreement (PPA): €/MWh

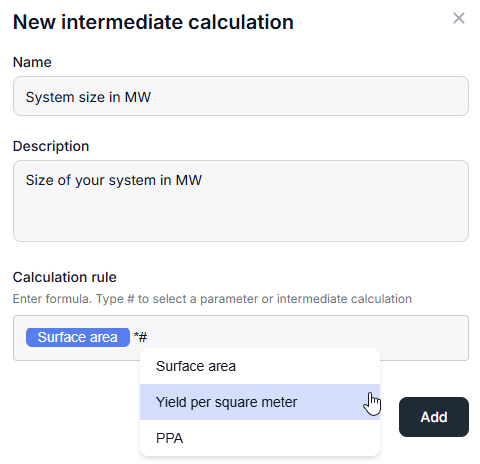

3) Define intermediate calculation formulas

An intermediate calculation is a formula that may be used as a basis for the other calculations, but is not assigned to a cashflow category, and as such is not part of the forecast results on its own. It is an optional step in creating a calculation formula and can be later used as a variable in the latter.

Steps

-

In the Intermediate calculations area, select +New intermediate calculation.

-

Enter an intermediate calculation Name and add a Description if desired.

-

For the Calculation rule, enter a formula.

-

Type a Hashtag

#to display the available parameters you created before. -

Use the following standard operators:

-

Plus

+ -

Minus

- -

Multiplication

* -

Division

/ -

Round parentheses

()may also be used

-

-

-

Select Add. The intermediate calculation will be added to your list of intermediate calculations.

Example

Define the intermediate calculation formula:

-

System size in MW =

Surface area * Generated energy per square meter

Further actions

-

Add additional intermediate calculations in the same manner if needed.

-

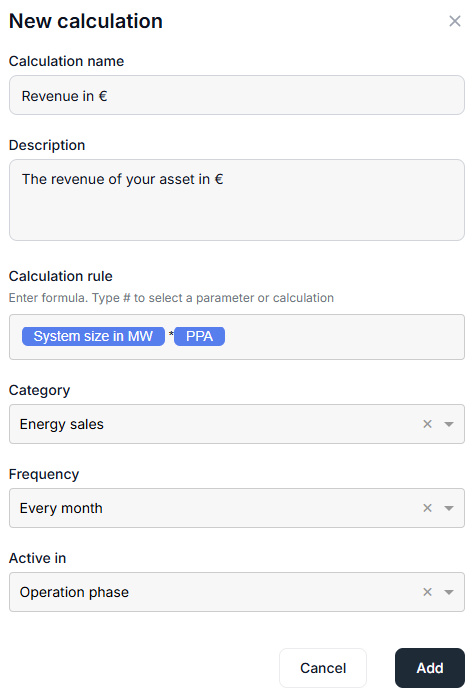

4) Define calculation formulas

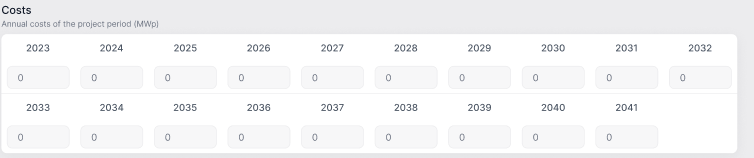

Calculations are the final formulas that will be used to create the financial model and financial forecasts. They are assigned to a cashflow category and can be carried out in different project phases.

Steps

-

In the Calculations area, select +New calculation.

-

Enter a calculation Name and add a Description if desired.

-

For the Calculation rule, enter a formula.

-

Type a Hashtag

#to display the available parameters and intermediate calculations you created before. -

Use the following standard operators:

-

Plus

+ -

Minus

- -

Multiplication

* -

Division

/ -

Round parentheses

()may also be used

-

-

-

Select a cashflow Category. The dropdown lists the categories to which bank transactions have been mapped, for example energy sales, capital expenditures (CAPEX), etc.

-

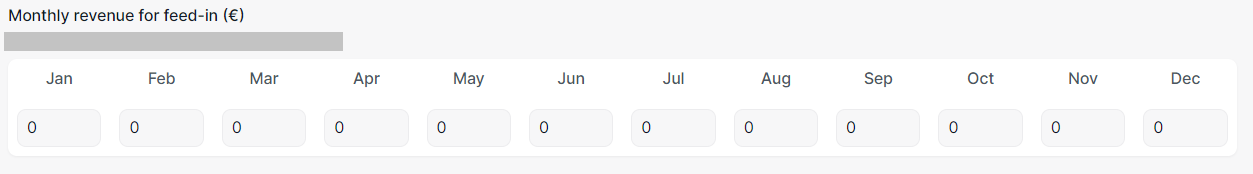

For the Frequency select an interval at which the calculation should be performed.

-

This will depend on the type of calculation you are creating. In the example, we are calculating monthly revenue.

-

If you carry out a calculation Once, it will be executed at the start date of the selected project phase.

-

Example

Define the calculation formula:

-

Revenue in € in the cashflow category Energy sales with a monthly calculation frequency while in operation phase

-

Select the phase in which you want the calculation to be Active in. The calculation will only consider the period between the start and end dates of the phase. In the example, it is active in the operation phase, in other words, when the asset is up and running and generating revenue.

-

Select Add. The calculation will be added to your list of calculations.

Further actions

-

Add additional calculations in the same manner if needed.

-

5) Finish financial modelling

Steps

When you are done with defining all of the above, select Finish in the upper right corner to finish your financial model.

The financial model will be added to your list of financial models.

Note

If your new financial model does not appear on your dashboard, try reloading the page in your browser or signing out and back in again.

Further actions

-

You can now create financial forecasts for your asset using the model you created. See Financial forecasts.

Duplicate a financial model

You can duplicate a financial model if you want to change specific parameters.

Example

Duplicate a financial model if you want to use an existing financial model in a financial forecast for an asset with a different currency. Therefore, change all currency settings in the duplicated financial model.

Steps

-

In platform view, select

-

For the respective model, select

-

The financial model is duplicated in the list.

-

For the duplicated financial model, select

You have duplicated a financial model now and only adjusted parts of it.

Delete a financial model

Note

You can not delete financial models that are in use in a financial forecast.

Steps

-

In platform view, select

-

For the respective model, select

The financial model and all its data is now deleted.